Recognizing the Different Kinds Of Home Loan Lendings Readily Available for First-Time Homebuyers and Their Distinct Advantages

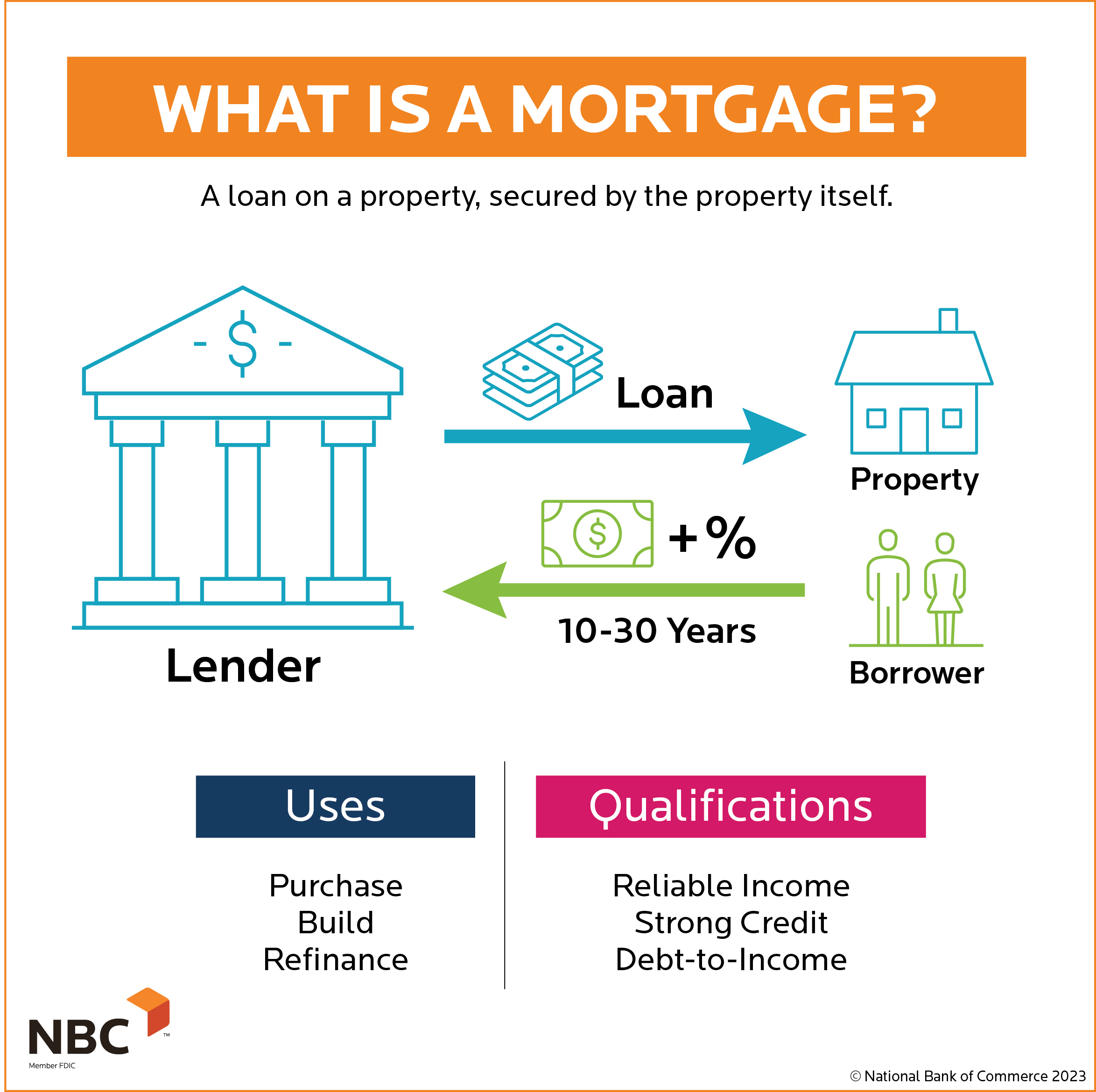

Navigating the range of mortgage funding choices offered to newbie property buyers is essential for making enlightened economic choices. Each kind of funding, from traditional to FHA, VA, and USDA, provides distinct advantages tailored to varied customer needs and situations.

Conventional Financings

Traditional loans are a foundation of home mortgage financing for new homebuyers, providing a trustworthy option for those looking to acquire a home. These lendings are not guaranteed or ensured by the federal government, which distinguishes them from government-backed loans. Generally, traditional car loans require a higher credit rating and a more substantial deposit, frequently ranging from 3% to 20% of the acquisition rate, depending on the lending institution's requirements.

One of the considerable benefits of standard lendings is their versatility. Debtors can select from various car loan terms-- most frequently 15 or three decades-- permitting them to straighten their home mortgage with their financial goals. Additionally, traditional fundings might use reduced rate of interest contrasted to FHA or VA financings, specifically for debtors with solid credit report accounts.

One more benefit is the absence of upfront mortgage insurance premiums, which are common with federal government finances. Exclusive home mortgage insurance coverage (PMI) may be required if the down settlement is much less than 20%, but it can be removed as soon as the debtor accomplishes 20% equity in the home. Overall, standard financings provide a eye-catching and practical financing alternative for novice buyers looking for to navigate the home mortgage landscape.

FHA Finances

For numerous first-time property buyers, FHA car loans stand for an easily accessible pathway to homeownership. Guaranteed by the Federal Housing Administration, these car loans provide versatile qualification requirements, making them ideal for those with limited credit report or reduced income levels. Among the standout features of FHA finances is their low down repayment need, which can be as low as 3.5% of the acquisition rate. This considerably lowers the financial barrier to access for numerous hopeful homeowners.

Additionally, FHA fundings enable greater debt-to-income proportions compared to conventional fundings, suiting borrowers who may have existing financial responsibilities. The rate of interest prices connected with FHA loans are frequently competitive, further improving cost. Debtors likewise gain from the capability to include specific closing expenses in the finance, which can reduce the ahead of time economic problem.

However, it is essential to note that FHA car loans need home loan insurance premiums, which can increase monthly payments. Regardless of this, the overall benefits of FHA car loans, including ease of access and lower initial prices, make them an engaging choice for novice homebuyers looking for to go into the property market. Comprehending these car loans is important in making informed choices regarding home financing.

VA Loans

VA financings supply a special financing remedy for qualified veterans, active-duty solution members, and certain participants of the National Guard and Reserves. These loans, backed by the united state Department of Veterans Matters, supply several benefits that make home ownership extra easily accessible for those who have actually served the country

One of one of the most significant advantages of VA car loans is the lack of a down repayment requirement, permitting certified image source customers to finance 100% of their home's acquisition cost. This attribute is particularly beneficial for new homebuyers who may battle to save for a considerable deposit. Additionally, VA lendings generally feature affordable rates of interest, which can bring about lower month-to-month repayments over the life of the lending.

One more remarkable advantage is the lack of exclusive mortgage insurance coverage (PMI), which is often needed on traditional loans with low down repayments. This exemption can result in substantial cost savings, making homeownership extra affordable. Additionally, VA financings offer flexible debt requirements, enabling customers with lower credit report to certify even more quickly.

USDA Fundings

Checking out financing choices, novice homebuyers may locate USDA loans to be an engaging selection, particularly for those seeking to buy residential property in country or rural locations. The United States Department of Farming (USDA) supplies these finances to promote homeownership in designated country areas, offering an outstanding opportunity for qualified purchasers.

One of the standout attributes of USDA finances is that they need no down payment, making it less complicated for newbie buyers to enter the real estate market. Additionally, these loans commonly have affordable rate of interest, which can result in decrease regular monthly payments contrasted to conventional funding options.

USDA financings likewise come with versatile credit scores needs, allowing those with view it less-than-perfect credit rating to certify. The program's income limitations ensure that support is routed towards reduced to moderate-income families, additionally sustaining homeownership goals in country areas.

Furthermore, USDA financings are backed by the government, which minimizes the useful reference threat for loan providers and can simplify the approval process for debtors (Conventional mortgage loans). Therefore, novice property buyers taking into consideration a USDA funding might find it to be a obtainable and beneficial option for accomplishing their homeownership dreams

Unique Programs for First-Time Buyers

Many first-time property buyers can benefit from unique programs developed to help them in browsing the intricacies of acquiring their initial home. These programs frequently offer monetary rewards, education and learning, and sources customized to the one-of-a-kind demands of amateur customers.

Moreover, the HomeReady and Home Possible programs by Fannie Mae and Freddie Mac accommodate low to moderate-income buyers, supplying versatile mortgage choices with decreased mortgage insurance policy expenses.

Educational workshops hosted by different organizations can additionally help new purchasers understand the home-buying procedure, improving their opportunities of success. These programs not only relieve monetary burdens however also equip buyers with understanding, ultimately assisting in a smoother transition right into homeownership. By exploring these special programs, new property buyers can uncover important resources that make the imagine possessing a home much more possible.

Conclusion

Conventional car loans are a cornerstone of home mortgage funding for novice homebuyers, providing a reliable alternative for those looking to acquire a home. These fundings are not insured or guaranteed by the federal government, which identifies them from government-backed finances. Furthermore, conventional loans might provide lower passion rates contrasted to FHA or VA finances, particularly for borrowers with solid credit report profiles.

In addition, FHA fundings allow for greater debt-to-income ratios contrasted to conventional loans, suiting customers that may have existing economic obligations. In addition, VA car loans commonly come with competitive passion rates, which can lead to decrease monthly repayments over the life of the lending.

Comments on “Understanding Conventional Mortgage Loans: Advantages and Needs”